Double top and double bottom patterns are key tools in the world of technical analysis, guiding traders single-out potential trend reversals. When a stock touches the same price level twice and fails to break through, it indicates that the trend may have decelerated momentum and could change direction. For those participating in stock trading, understanding these patterns can bring strategic entry and exit points, assisting manage risk and optimize returns.

Key Points

- Double tops and bottoms indicate potential trend reversals.

- Traders use these patterns to set entry, exit, and stop-loss points.

- Patterns may sometimes give false signals, so combining them with other indicators is advisable.

What are Double Tops and Double Bottoms?

Double tops and bottoms are classic chart patterns that recommend a trend may be overturning. A double top typically indicates a bearish change, while a double bottom signals a bullish reversion.

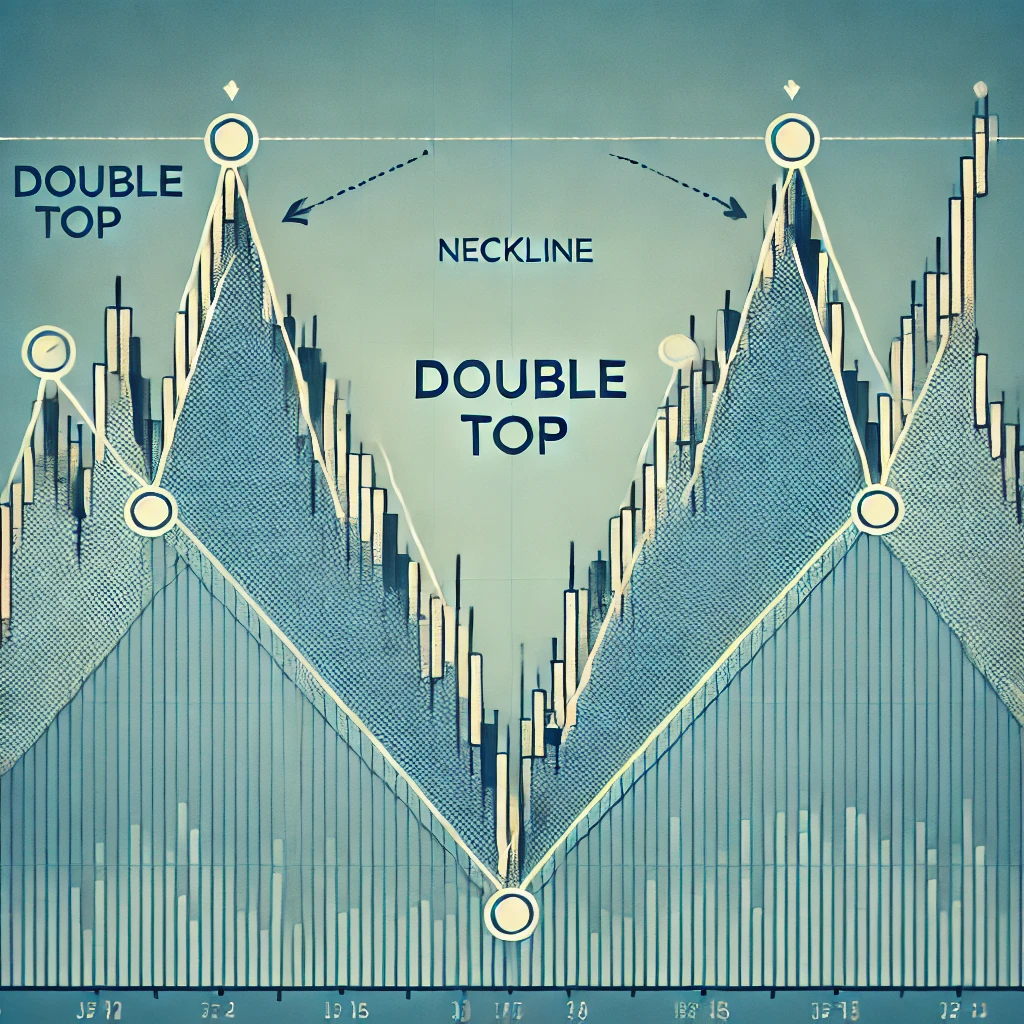

Double Top Pattern

A double top shows when a stock’s price hits a peak, drops, and then rises again to the same level, only to reverse once more. This pattern advises that buyers tried twice to push the stock above a certain level but crashed, signaling that the trend is running out of steam.

- Formation: Two nearly identical peaks.

- Support Level (Neckline): The lowest point between the peaks.

- Signal: When the stock price breaks below the neckline, it signals further downside.

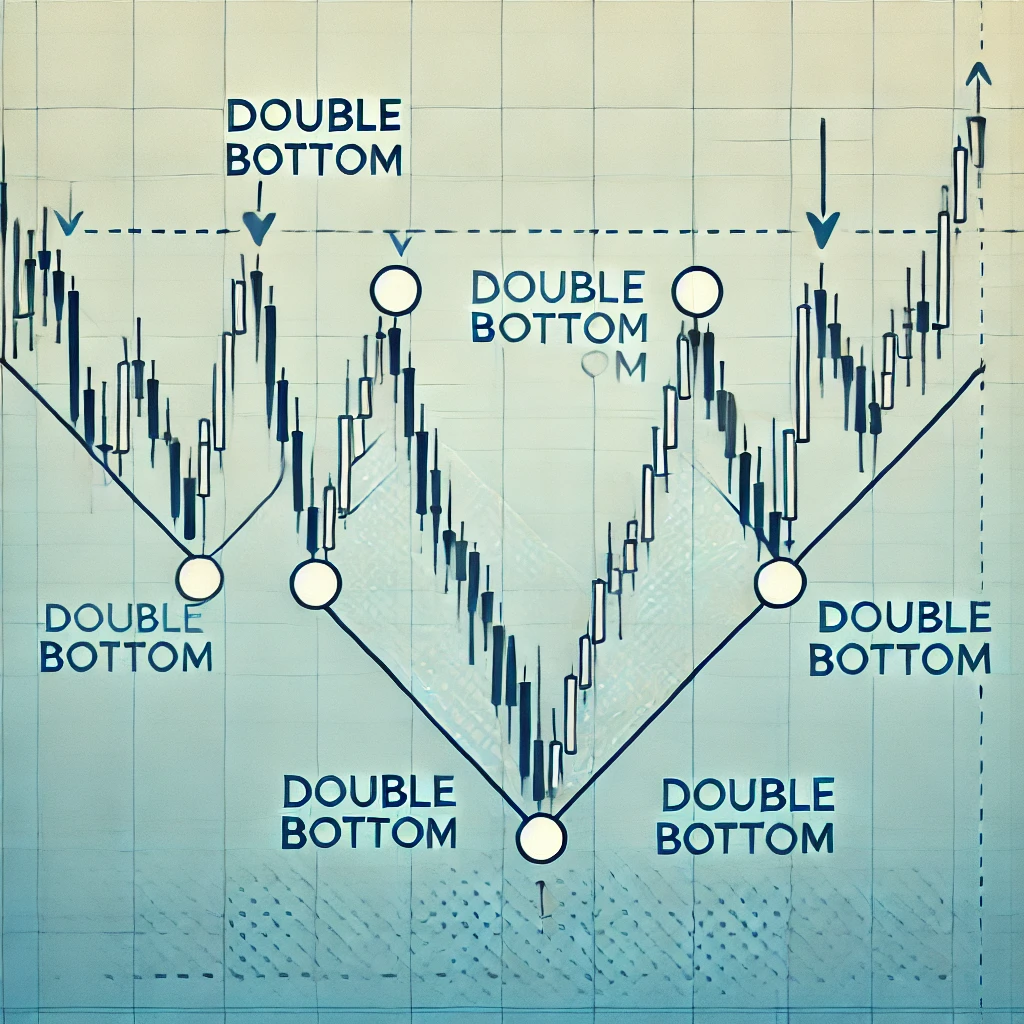

Double Bottom Pattern

Conversely, a double bottom takes place when the stock touches a low point, rises, drops back to the same level, and then moves upward. This pattern guides that sellers have been incapable to push the stock price below a certain level, signaling that the trend might reverse upward.

- Formation: Two nearly identical troughs.

- Resistance Level (Neckline): The highest point between the troughs.

- Signal: When the stock price breaks above the neckline, it signals potential upside.

How to Identify Double Tops and Bottoms

Identifying a Double Top

A double top is a bearish reversal pattern, showing two peaks at nearly the same price. Below is a typical double top chart with important points marked.

- Neckline: The lowest price between the two peaks.

- Breakdown Point: If the price falls below the neckline, it often signals a bearish trend.

- Target Price: Measure the distance from the peak to the neckline to estimate the downside potential.

Identifying a Double Bottom

A double bottom is a bullish reversal pattern, characterized by two bottoms at nearly the same price level. Below is an example of a double bottom chart.

- Neckline: The highest point between the two bottoms.

- Breakout Point: If the price rises above the neckline, it often signals bullish momentum.

- Target Price: Measure the distance from the bottom to the neckline to estimate the potential upside.

Table: Key Differences Between Double Tops and Double Bottoms

| Pattern | Trend | Neckline Role | Indicates |

|---|---|---|---|

| Double Top | Bearish | Acts as support | Trend reversal downward |

| Double Bottom | Bullish | Acts as resistance | Trend reversal upward |

The Psychology Behind Double Top and Double Bottom Patterns

Double tops and bottoms show a battle between buyers and sellers. In a double top, buyers hit the price up to a certain level, but sellers opposes further advances, concluding in a reversal. In a double bottom, sellers push the price down, but buyers help it, leading to a reversal.

Psychology of a Double Top

- Buyers push the stock price to a high point.

- Sellers resist and push the price down.

- Buyers try to push the price up again, but sellers halt the attempt at the same level.

- Sellers take control, signaling a bearish reversal.

Psychology of a Double Bottom

- Sellers push the stock price to a low.

- Buyers intervene and push the price up.

- Sellers attempt to drive the price down again but fail at the same level.

- Buyers regain control, signaling a bullish reversal.

How to Use Double Tops and Bottoms in Your Trading Strategy

Whether you’re an active trader or a long-term investor, getting how to use double tops and bottoms can guide strategic advantages.

- Identify Entry and Exit Points: Enter a trade when the stock price crosses the neckline, confirming the trend reversal.

- Set Stop-Loss Levels: Place a stop-loss slightly above or below the neckline, depending on the trade direction.

- Estimate Price Targets: Use the height from the peak or bottom to the neckline to project a price target.

Using Other Indicators to Confirm Patterns

To minimize wrong signals, traders often mix double tops and bottoms with other indicators:

- Moving Averages: Confirm the trend direction by observing the moving averages.

- Volume Analysis: Increased volume on a breakout indicates strong support for the new trend.

- Relative Strength Index (RSI): An RSI above 70 suggests overbought conditions, while below 30 indicates oversold.

FAQ: Common Questions About Double Tops and Double Bottoms

Can double tops and bottoms give false signals?

Yes, these patterns can sometimes present false signals. It’s advisable to confirm with other indicators.

How reliable are double tops and bottoms in predicting trends?

While these patterns are widely used, they should be part of a broader analysis, not used in isolation.

Should I always trade based on double top or bottom patterns?

No, always consider additional market conditions, and use stop-loss orders to manage risks.

How do I know if the breakout is genuine?

Look for high trading volume at the neckline breakout to confirm the trend reversal.

Summary

Double tops and bottoms are effective tools for spotting trend reversals in stock trading. By knowing these patterns, traders can make well informed entry and exit decisions, manage risk, and better realize market psychology. Remember to mix these patterns with other technical indicators for more authentic signals.

Leave a Comment